The Best Strategy To Use For Company Liquidation

Table of ContentsEverything about Company LiquidationExcitement About Company LiquidationFacts About Company Liquidation UncoveredThe Of Company LiquidationCompany Liquidation Things To Know Before You BuyCompany Liquidation Can Be Fun For Anyone

As soon as under method, a CVL is under the effective control of the financial institutions, who can designate a liquidator of their selection. Company Liquidation. At this stage, the role of the supervisors is terminated. The Creditors Voluntary Liquidation procedure is used when a firm has come to the end of its valuable lifeUltimately it is the supervisors that commence the process in a Creditors Voluntary Liquidation. The directors will officially deal with that the firm can not continue to trade due to its financial obligations, and they appoint a Qualified Insolvency Professional as the liquidators who prepares a statement of events to be presented to the lenders.

Whilst in the financial distress stage, it is still feasible to restructure and turn things around if aid is hired promptly enough, as our programs. If points do not boost, after that distress turns into a dilemma, and that is when the business's financial obligation the money that it owes to its financial institutions are at a level which implies that liquidation is the only genuine alternative.

See This Report on Company Liquidation

Our function is to oversee an organized liquidation prior to we dissolve it. For even more info, assistance and suggestions concerning a Creditors Voluntary Liquidation, please The very first assessment is FREE.

A mandatory firm liquidation (or mandatory winding up) is set up by an order made by the court, normally on the petition of a creditor, the company or a shareholder. There are a number of feasible reasons for making a winding-up order. One of the most typical is since the business is bankrupt.

In a mandatory liquidation the function of a liquidator remains in many instances initially executed by an official called the. The Official Receiver is a police officer of the court and a member of the Insolvency Solution, an exec agency within the In most required liquidations, the Official Receiver ends up being the liquidator quickly on the making of the winding-up order.

7 Easy Facts About Company Liquidation Explained

This takes place either at a conference of creditors convened for the purpose or directly by the Secretary of State. Where an insolvency practitioner is not designated the Official Receiver remains liquidator. Where a mandatory liquidation complies with right away on from an, the court may designate the former administrator to serve as liquidator.

Your minimal firm might be liquidated (wound up) if it can not pay people or organisations it owes money to (its creditors). When your company owes cash the financial institutions might attempt to recuperate the financial obligation by issuing an official demand for settlement, called a legal demand.

This typically my link implies shutting the firm and placing property and properties under the control of a provisionary liquidator selected by the court. The court provides a winding-up order if it decides your company can not pay its financial debts and is financially troubled. A liquidator will be appointed. They will certainly take control of the business and its possessions.

Some Of Company Liquidation

You and any kind of other of the business's directors must co-operate with the liquidator. You can be prohibited from being a director for up to 15 years or prosecuted if you have actually fallen short to lug out your duties as a supervisor or broken the legislation.

The company liquidation procedure is equivalent to browsing a lengthy and winding road at night there are potential stumbling blocks and stumbling blocks around every edge. That is, unless you have an insolvency expert in your edge to help light the method. The beginning of the liquidation process indicates the start of completion of a company as a legal entity.

Little Known Facts About Company Liquidation.

From discovering optimal choices, the obstacles you could encounter, and the crossroads you can expect to be waiting on you when the procedure is full. Firm liquidation is the procedure of shutting down a limited company with the help of a selected Bankruptcy Manager - Company Liquidation, also called a liquidator. The liquidator is brought into the company to 'wind up' all continuous affairs up until, at click this the end of the process, the business is brought to a close.

A lot more often than not, HMRC will certainly be the major financial institution because of unpaid taxes such as Firm Tax Obligation, VAT, Pay As You Earn (PAYE) or National Insurance Contributions (NIC). Profession financial institutions, such as distributors, will certainly also be able to act if they think they are unlikely to be paid what they are owed.

If this occurs, it is crucial that you act rapidly as time is going out to conserve your firm. Must there be no action to the Winding Up Petition within seven days of it being issued, your firm will then be sent out a Winding Up Order to force you to close.

Facts About Company Liquidation Uncovered

They will talk Homepage you with every one of the choices readily available to you and suggest what they think is the most effective strategy for you to take. A MVL can be asked for if your firm is solvent however you still desire to shut it down. It is one of the most prominent alternative with company proprietors as it is the most tax-efficient method to quit trading.

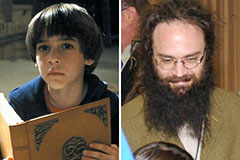

Barret Oliver Then & Now!

Barret Oliver Then & Now! Seth Green Then & Now!

Seth Green Then & Now! James Van Der Beek Then & Now!

James Van Der Beek Then & Now! Lacey Chabert Then & Now!

Lacey Chabert Then & Now! The Olsen Twins Then & Now!

The Olsen Twins Then & Now!